Cards for Low CIBIL Score – Smart Choices for a Fresh Start

Unlock Access to India’s Most Credit-Friendly Cards

Have a CIBIL score between 600–700? Don’t worry — you can still get a great credit card that builds trust and delivers value. Whether you’re rebuilding credit, just getting started, or recovering from past delays — CardMela.com brings you a carefully curated list of credit cards for low CIBIL scores that focus on accessibility, approval, and financial recovery.

These cards are selected not just for their relaxed credit criteria — but for offering real-world benefits, transparent terms, and the opportunity to improve your credit profile while enjoying everyday perks.

Enjoy a balance of features and flexibility, including cashback, rewards, low fees, and high approval chances — all in one place.

Explore top options like the AU Bank Instapay, YES Bank POP, ICICI Bank Expressions, and Axis Bank Airtel Card — each designed to suit your needs even if your credit isn’t perfect.

These cards also come with added benefits like:

- Higher approval odds even with a score in the 600–700 range

- Low or zero joining fees with lifetime free variants

- Reward points on everyday spending like groceries, fuel, dining

- Spend-based fee waivers to keep long-term costs low

- Simple online application with minimal documentation

Looking to rebuild or boost your score? Use our comparison tool to explore smart, low-risk cards that offer both approval and growth.l to check features, annual fees, eligibility, and apply for your favourite card today — only on CardMela.com.

AU Bank Instapay Credit Card

★★★★☆ (4.5/5)

Ideal for digital payment enthusiasts and frequent UPI users

Benefits:

1% Cashback on UPI transactions (maximum ₹100 per billing cycle)

1% Fuel Surcharge Waiver on transactions ₹400–₹5,000 (maximum ₹100 per billing cycle)

Lifetime Free Card (No Joining Fee, No Annual Fee)

Contactless & Secure Payments

Instant UPI Payments through linked UPI apps

Easy linking with Google Pay, PhonePe, and Paytm

Eligibility:

Age 18-70 years, Minimum ₹1,00,000 annual income, Credit Score 750+, India resident, existing AU Bank customers

Fees:

No Joining or Annual Fee, Late Payment Fee ₹150–₹1,000 based on balance

ICICI Bank Expressions Forex Credit Card

★★★★☆ (4.5/5)

Ideal for premium international travelers

Benefits:

Personalized card design

₹15,000 joining benefits

Zero cross-currency markup

5% cashback on airline & hotel bookings (max ₹3,000/month)

2 free international lounge accesses/year

₹1,000 Uber e-Gift Card

ISIC membership worth ₹999

Card Protection Plus insurance worth ₹1,600

Eligibility:

Valid passport required

A2 Form and PAN card necessary

Fees:

Joining fee ₹2,999 + GST

Annual fee Nil

Reload fee ₹100 per transaction

IDFC First Bank Classic Credit Card

★★★★☆ (4.5/5)

Best for lifetime-free card with good rewards

Benefits:

₹500 gift voucher on ₹5,000 spend within 30 days

5% cashback on first EMI (up to ₹1,000)

3X reward points on UPI spends

10X points on spends above ₹20,000/month & birthdays

1% fuel surcharge waiver

25% off on movie tickets (up to ₹100/month)

4 railway lounge visits per quarter

₹2L personal accident cover

Eligibility:

Annual income ₹3L+

₹5,000 spend within 30 days for welcome benefits

Fees:

Joining fee ₹0

Annual fee ₹0

SBI Simply Click Credit Card

★★★★☆ (4.3/5)

Best for online shoppers seeking accelerated rewards on digital spends

Benefits:

10X Reward Points on online spends at partner merchants (Amazon, BookMyShow, Cleartrip, Dominos, Myntra, Netmeds, Yatra, Apollo 24/7)

5X Reward Points on other online spends

1X Reward Point per ₹100 on offline spends

₹500 Amazon gift voucher on payment of joining fee

Cleartrip e-vouchers worth ₹2,000 on annual online spends of ₹1L and ₹2L

1% fuel surcharge waiver on transactions between ₹500–₹3,000 (max ₹100/month)

Eligibility

Minimum ₹20,000/month income, Credit Score 700+

Fees

₹499 Joining & Annual Fee (waived on ₹1L spend/year), Late Fee ₹100–₹1,300

Axis Bank Airtel Credit Card

★★★★☆ (4.2/5)

Ideal for Airtel users and utility bill payers

Benefits:

25% cashback on Airtel mobile, broadband & DTH payments

10% cashback on utility bill payments via Airtel Thanks app

1% cashback on other spends

1% fuel surcharge waiver (₹400–₹4,000 transactions, max ₹500/month)

Eligibility:

Salaried individuals with ₹25,000/month income, Credit Score 750+

Fees:

₹500 Joining Fee, ₹500 Annual Fee (waived on ₹2L spend/year), Late Fee ₹100–₹1,300

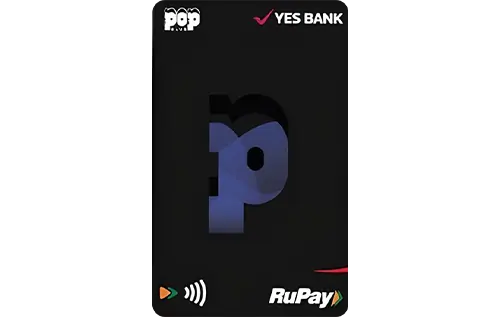

YES Bank POP Club Credit Card

★★★★☆ (4.5/5)

Best for young shoppers and frequent UPI users

Benefits:

Earn 10 POPcoins per ₹100 online spends

2 POPcoins per ₹100 offline spends

5% extra POPcoins on UPI via POP app

Welcome gifts: 500 POPcoins, Zomato Gold, PharmEasy Plus, Cleartrip ₹750 voucher, Cult Sport ₹500 voucher, 24 free Rapido rides

1% fuel surcharge waiver and travel discounts

Eligibility:

Age 21–60 years, salaried or self-employed

Minimum monthly income ₹25,000 or annual ITR ₹5 lakh

Fees:

Joining fee ₹0

Annual fee ₹399 (waived on ₹1.5 lakh spends)

Most Approachable. Most Forgiving. Most Credit-Building.

Not sure which card you’ll qualify for with a low CIBIL score? Start with the ones that are designed to say yes when others say no.

This page features the most approved and user-friendly credit cards on CardMela for those with credit scores between 600–700 — selected for their relaxed eligibility, useful features, and ability to help rebuild your credit while rewarding your everyday spending.

Why These Cards Are Perfect for Score Recovery

Easier Approval Odds

Tailored for users with fair or limited credit history — higher chance of acceptance.

Essential Benefits, No Fluff

Get cashback, rewards, and fuel benefits without needing a perfect score.

Credit Growth Opportunity

Regular use and timely payments can help you gradually improve your credit health.

No Hidden Traps

Low joining fees, clear terms, and manageable credit limits for safe usage.

Who Chooses These Credit-Friendly Cards?

Young professionals with new or thin credit files

Self-employed individuals with past delays

Users recovering from financial setbacks

People who’ve been denied by mainstream banks

Anyone looking to build or rebuild their CIBIL score

Credit Confidence Starts Here

CardMela helps you compare trusted, credit-friendly cards, find the ones with best approval chances, and apply in minutes — with no judgment, just smarter options.

Compare. Apply. Rebuild.

Your second chance starts today.

Explore favorites. Choose confidently. Apply in minutes. Find it today.