Low Annual Fee Credit Cards (Under ₹500) – Affordable. Reliable. Rewarding.

Big Benefits Without Breaking the Bank

Looking for a credit card that offers real value without a hefty price tag? At CardMela.com, we’ve curated a list of Low Annual Fee Credit Cards (Under ₹500) that are perfect for budget-conscious users who still want cashback, rewards, and premium experiences — without paying thousands in yearly fees.

Whether you’re a student, a salaried professional, or simply looking to add a second card with great perks — these cards give you the best of both worlds: affordability and functionality.

Explore top picks like the SBI Sprint Cashback, Axis My Zone, Airtel Axis Bank, ICICI Manchester United, and IDFC FIRST Classic — all designed for different types of spending, but united by low costs and high user satisfaction.

These cards also come with added benefits like: cashback or reward points on digital and retail spends; airport lounge access and fuel surcharge waivers; free subscriptions or lifestyle offers with first swipe; spend-based annual fee waivers on most variants; UPI compatibility and EMI-friendly features.

These cards are not only budget-friendly — they’re smart for long-term usage.

Ready to earn more while spending less? Use our comparison tool to explore features, joining fees, annual charges, and apply for your favourite Low-Fee Credit Card today — only on CardMela.com.

SBI Sprint Cashback Credit Card

★★★★☆ (4.0/5)

Ideal for moderate fuel spenders and online shoppers

Benefits:

10 Reward Points per ₹150 spent on Dining, Movies, Grocery, and Departmental Stores

1 Reward Point per ₹150 on other spends

2,000 bonus Reward Points on spending ₹2,000 within 60 days of issuance

1% fuel surcharge waiver on transactions between ₹500–₹3,000 (max ₹100/month)

Contactless payments enabled

Reward Points redeemable against outstanding balance or a wide array of gifts

Eligibility:

₹25,000/month income, Credit Score 750+

Fees:

₹500 Joining & Annual Fee (waived on ₹3.5L spend/year), Late Fee ₹100–₹1,300

Axis Bank Airtel Credit Card

★★★★☆ (4.2/5)

Ideal for Airtel users and utility bill payers

Benefits:

25% cashback on Airtel mobile, broadband & DTH payments

10% cashback on utility bill payments via Airtel Thanks app

1% cashback on other spends

1% fuel surcharge waiver (₹400–₹4,000 transactions, max ₹500/month)

Eligibility:

Salaried individuals with ₹25,000/month income, Credit Score 750+

Fees:

₹500 Joining Fee, ₹500 Annual Fee (waived on ₹2L spend/year), Late Fee ₹100–₹1,300

Axis Bank My Zone Credit Card

★★★★☆ (4.0/5)

Ideal for entertainment enthusiasts

Benefits:

Complimentary SonyLIV Premium subscription

Flat ₹120 off on Swiggy (twice a month)

Complimentary lounge access

1% fuel surcharge waiver (₹400–₹4,000 transactions)

Eligibility:

Salaried individuals with ₹25,000/month income, Credit Score 750+

Fees:

₹500 Joining Fee, ₹500 Annual Fee (waived on ₹2L spend/year), Late Fee ₹100–₹1,300

Axis Bank Neo Credit Card

★★★☆☆ (3.8/5)

Ideal for beginners and online shoppers

Benefits:

10% off on Myntra, BookMyShow & Zomato

5% off on utility bill payments

1% fuel surcharge waiver (₹400–₹4,000 transactions)

Eligibility:

Salaried individuals with ₹25,000/month income, Credit Score 750+

Fees:

₹250 Joining Fee, ₹250 Annual Fee (waived on ₹1L spend/year), Late Fee ₹100–₹1,300

AU Bank Zenith Credit Card

★★★★☆ (4/5)

*Waiver on spends over ₹50,000/year

Benefits:

Up to 5% Cashback

₹1,000 Welcome Bonus

₹500 Fuel Waiver/month

Lounge Access

Dining Discounts

₹999 Annual Fee (waived*)

Eligibility:

₹25,000/month income, Credit Score 750+

Fees:

₹999 Annual Fee (waived*), ₹500 Late Fee approx.

AU Bank Business Credit Card

★★★★☆ (4/5)

★★★☆☆ (3.8/5)

*Designed for entrepreneurs and small business owners

Benefits:

Up to 2% Cashback on business spends

₹500 Welcome Cashback on first transaction

Fuel Surcharge Waiver up to ₹200/month

Free Add-on Cards

RuPay Offers & UPI Credit Card Compatibility

Eligibility:

₹25,000/month income, Self-employed or Business Owners, Credit Score 700+

Fees:

₹499 Annual Fee (waived on ₹40,000 annual spend), ₹500 Late Payment Fee approx.

ICICI Coral Credit Card

★★★★☆ (4.2/5)

Best for movie lovers & frequent travelers

Benefits:

2 reward points per ₹100 spent

25% off on 2 movies/month via BookMyShow & INOX

1 free domestic lounge + 1 railway lounge access quarterly

1% fuel surcharge waiver at HPCL

Exclusive dining offers & chip-enabled security

Eligibility:

Age 21–58 years (salaried)

Minimum ₹15,000 monthly income

Fees:

Joining fee ₹500 + GST

Annual fee ₹500 + GST (waived on ₹1.5L annual spend)

SBI Simply Click Credit Card

★★★★☆ (4.3/5)

Best for online shoppers seeking accelerated rewards on digital spends

Benefits:

10X Reward Points on online spends at partner merchants (Amazon, BookMyShow, Cleartrip, Dominos, Myntra, Netmeds, Yatra, Apollo 24/7)

5X Reward Points on other online spends

1X Reward Point per ₹100 on offline spends

₹500 Amazon gift voucher on payment of joining fee

Cleartrip e-vouchers worth ₹2,000 on annual online spends of ₹1L and ₹2L

1% fuel surcharge waiver on transactions between ₹500–₹3,000 (max ₹100/month)

Eligibility

Minimum ₹20,000/month income, Credit Score 700+

Fees

₹499 Joining & Annual Fee (waived on ₹1L spend/year), Late Fee ₹100–₹1,300

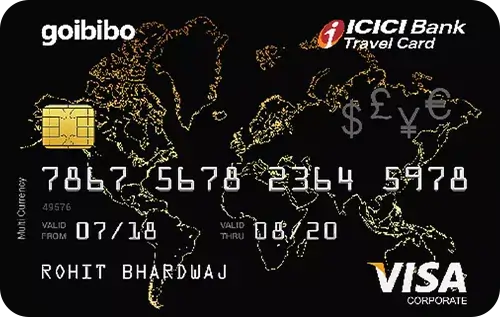

ICICI Bank Mine Goibibo Credit Card

★★★★☆ (4.3/5)

Best for frequent travelers aur Goibibo users

Benefits:

Goibibo par domestic flights par flat 6% instant discount (up to ₹800)

Goibibo par domestic hotels par flat 7% instant discount (up to ₹5,000)

Zomato, Swiggy, Amazon, PVR, BookMyShow, Myntra, MakeMyTrip, Ola, BigBasket par 5% cashback

Fuel surcharge waiver at HPCL pumps

Complimentary airport aur railway lounge access eligibility ke hisaab se

Eligibility:

Salaried ya self-employed professionals

Minimum monthly income ₹15,000

Fees:

Joining fee ₹500 + GST

Annual fee ₹500 + GST (waived on ₹1.5L annual spend)

ICICI Bank HPCL Credit Card

★★★★☆ (4.4/5)

Best for regular fuel and utility bill payments

Benefits:

5% cashback on HPCL fuel via ICICI POS or HP Pay

5% rewards on utilities and departmental stores

2 reward points per ₹100 on other spends

Movie discount ₹100 twice a month

1 lounge access/quarter on ₹75K spend

₹2L accident cover (RuPay only)

Eligibility:

Age 21–65 years

Salaried or self-employed with good credit score

Fees:

Joining fee ₹500 + GST

Annual fee ₹500 + GST (waived on ₹1.5L spend)

Tata Neu HDFC Plus Credit Card

★★★★☆ (4.5/5)

Best for Tata brand fans wanting high rewards

Benefits:

2% NeuCoins on Tata Neu & partner brands (non-EMI spends)

1% NeuCoins on non-Tata brand spends & EMI transactions

1% NeuCoins on UPI spends via RuPay (max ₹500/month)

Additional 5% NeuCoins on Tata Neu App/Website with NeuPass

Welcome benefit: 499 NeuCoins on first transaction within 30 days

4 complimentary domestic lounge visits per year (1 per quarter)

1% fuel surcharge waiver (up to ₹250/month)

Eligibility

Salaried 21–60 years with ₹25,000+ monthly income

Self-employed 21–65 years with ₹6 lakh+ annual income

Fees

Joining fee ₹499 + GST

Annual fee ₹499 + GST waived on ₹1 lakh annual spend

AU Bank Business Credit Card

★★★★☆ (4/5)

★★★☆☆ (3.8/5)

*Designed for entrepreneurs and small business owners

Benefits:

Up to 2% Cashback on business spends

₹500 Welcome Cashback on first transaction

Fuel Surcharge Waiver up to ₹200/month

Free Add-on Cards

RuPay Offers & UPI Credit Card Compatibility

Eligibility:

₹25,000/month income, Self-employed or Business Owners, Credit Score 700+

Fees:

₹499 Annual Fee (waived on ₹40,000 annual spend), ₹500 Late Payment Fee approx.

Axis Bank Flipkart Credit Card

★★★★☆ (4.5/5)

Ideal for Flipkart shoppers and online spenders

Benefits:

5% cashback on Flipkart & Myntra

4% cashback on Swiggy, Uber & PVR

1.5% cashback on other spends

4 complimentary lounge visits/year

1% fuel surcharge waiver (₹400–₹4,000 transactions, max ₹500/month)

Eligibility:

Salaried individuals with ₹25,000/month income, Credit Score 750+

Fees:

₹500 Joining Fee, ₹500 Annual Fee (waived on ₹3.5L spend/year), Late Fee ₹100–₹1,300

Axis Bank Indian Oil Credit Card

★★★★☆ (4.0/5)

Ideal for moderate fuel spenders and online shoppers

Benefits:

20 EDGE Reward Points per ₹100 spent at IOCL fuel outlets (₹100–₹5,000/month)

5 EDGE Reward Points per ₹100 on online shopping (₹100–₹5,000/month)

1 EDGE Reward Point per ₹100 on other spends

1% fuel surcharge waiver (₹400–₹4,000 transactions, max ₹50/month)

100% cashback up to ₹250 on first fuel transaction within 30 days

10% off on BookMyShow tickets, 15% off on dining via EazyDiner

Eligibility:

₹25,000/month income, Credit Score 750+

Fees:

₹500 Joining & Annual Fee (waived on ₹3.5L spend/year), Late Fee ₹100–₹1,300

SBI IRCTC Platinum Credit Card

★★★★☆ (4/5)

Best for regular train travelers and IRCTC users

Benefits:

10% value back on IRCTC bookings, 350 bonus RP on activation, 8 complimentary railway lounge visits/year, 1% fuel surcharge waiver, low annual fee

Eligibility

₹20,000/month income, Credit Score 700+

Fees

₹500 Annual Fee, ₹500 Late Payment Fee approx

Most Applied. Most Trusted. Most Affordable.

Top Low-Fee Credit Cards That Deliver Maximum Value for Under ₹500

Not sure which budget-friendly card to pick? Start with the ones users apply for the most. This list features the most popular and frequently chosen low annual fee credit cards (under ₹500) by CardMela users — selected for their everyday usability, high approval rates, and unmatched value at a low cost.

From cashback and rewards to lounge access and partner discounts, these cards pack serious benefits without burning a hole in your pocket. Whether you’re new to credit or just want an affordable second card, these top picks deliver.

Why These Are Favourites

Consistent Benefits

Even with a low fee, these cards offer strong returns — cashback, brand discounts, and fuel waivers that actually add up.

High Approval Rates

Simple eligibility, fast onboarding, and good issuer reputation make these cards the go-to for thousands of users.

Low Commitment, Big Perks

Most cards offer spend-based annual fee waivers, so you often end up paying nothing if you use the card regularly.

Reliable Issuers

Top banks like SBI, Axis, ICICI, and IDFC FIRST — with proven customer service and digital tools.

Who Picks These?

First-time credit card applicants with limited income

Online shoppers and OTT subscribers on a budget

Students and young professionals building credit

Smart spenders who want more value at less cost

Explore the Most Popular Low-Fee Credit Cards Today

CardMela helps you compare features, check eligibility, and apply online with ease. Low annual fees. Transparent terms. Real benefits.

Your perfect budget card is just a click away — only on CardMela.com.

Explore favorites. Choose confidently. Apply in minutes. Find it today.