Credit Cards for Students & Young Professionals – Smart Starts with Big Potential

Unlock the Power of Beginner-Friendly, Reward-Rich Credit Cards

Just starting out with your career or education? Whether you’re a student looking for your first card, or a young professional aiming to manage money smartly — CardMela.com brings you a carefully curated list of Credit Cards for Students and Young Professionals that offer easy access, low fees, and real rewards.

These cards are chosen not just for beginner compatibility — but for offering practical, everyday benefits, digital-first experiences, and the chance to build a healthy credit profile from the ground up.

Enjoy key advantages like cashback on food delivery, UPI compatibility, zero joining fees, and spend tracking — all built for a fast-moving, digital lifestyle.

Explore top picks like the OneCard, ICICI Amazon Pay, IDFC FIRST Classic, Axis Neo, and SBI Student Plus Advantage — each suited for growing financial independence and future planning.

These cards also come with added benefits like:

- Easy eligibility with basic income, student ID, or bank deposits

- Rewards on online shopping, mobile recharges, and OTT subscriptions

- App-based control with spend limits, usage tracking, and instant statements

- Low or zero annual fees with options for fee waivers

- UPI linking, EMI options, and tap-to-pay support on select variants

Ready to build your financial journey with confidence? Use our comparison tool to explore beginner-friendly cards, check eligibility, and apply for the one that fits your student or early-career life — only on CardMela.com.

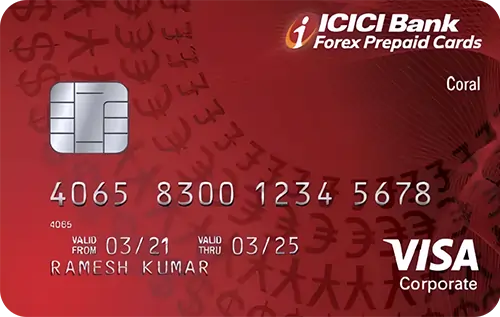

ICICI Bank Forex Prepaid Credit Card

★★★★☆ (4.3/5)

Ideal for frequent international travelers

Benefits:

Multiple currencies on a single card

Free replacement card in case of loss or theft

Comprehensive travel insurance coverage

Secure transactions with 3D Secure and Chip & PIN technology

Emergency cash delivery services available

Eligibility:

Valid passport required

A2 Form and PAN card necessaryICICI Bank

Fees:

Joining fee: ₹499 + GST

Annual fee: Nil

Reload fee: ₹100 per transaction

ICICI Bank Expressions Forex Credit Card

★★★★☆ (4.5/5)

Ideal for premium international travelers

Benefits:

Personalized card design

₹15,000 joining benefits

Zero cross-currency markup

5% cashback on airline & hotel bookings (max ₹3,000/month)

2 free international lounge accesses/year

₹1,000 Uber e-Gift Card

ISIC membership worth ₹999

Card Protection Plus insurance worth ₹1,600

Eligibility:

Valid passport required

A2 Form and PAN card necessary

Fees:

Joining fee ₹2,999 + GST

Annual fee Nil

Reload fee ₹100 per transaction

AU Bank Instapay Credit Card

★★★★☆ (4.5/5)

Ideal for digital payment enthusiasts and frequent UPI users

Benefits:

1% Cashback on UPI transactions (maximum ₹100 per billing cycle)

1% Fuel Surcharge Waiver on transactions ₹400–₹5,000 (maximum ₹100 per billing cycle)

Lifetime Free Card (No Joining Fee, No Annual Fee)

Contactless & Secure Payments

Instant UPI Payments through linked UPI apps

Easy linking with Google Pay, PhonePe, and Paytm

Eligibility:

Age 18-70 years, Minimum ₹1,00,000 annual income, Credit Score 750+, India resident, existing AU Bank customers

Fees:

No Joining or Annual Fee, Late Payment Fee ₹150–₹1,000 based on balance

Tata Neu HDFC Plus Credit Card

★★★★☆ (4.5/5)

Best for Tata brand fans wanting high rewards

Benefits:

2% NeuCoins on Tata Neu & partner brands (non-EMI spends)

1% NeuCoins on non-Tata brand spends & EMI transactions

1% NeuCoins on UPI spends via RuPay (max ₹500/month)

Additional 5% NeuCoins on Tata Neu App/Website with NeuPass

Welcome benefit: 499 NeuCoins on first transaction within 30 days

4 complimentary domestic lounge visits per year (1 per quarter)

1% fuel surcharge waiver (up to ₹250/month)

Eligibility

Salaried 21–60 years with ₹25,000+ monthly income

Self-employed 21–65 years with ₹6 lakh+ annual income

Fees

Joining fee ₹499 + GST

Annual fee ₹499 + GST waived on ₹1 lakh annual spend

IDFC First Bank Millennia Credit Card

★★★★☆ (4.5/5)

Best for millennials with perks

Benefits:

₹500 voucher on ₹5,000 spend

5% cashback on 1st EMI

3X points up to ₹20K spends

10X points on ₹20K+ spends & birthdays

1% fuel surcharge waiver

25% off on movies

4 railway lounge visits quarterly

₹2L accident cover

Eligibility:

₹3L+ annual income

Indian resident, good credit score

Fees:

Joining ₹0

Annual ₹0

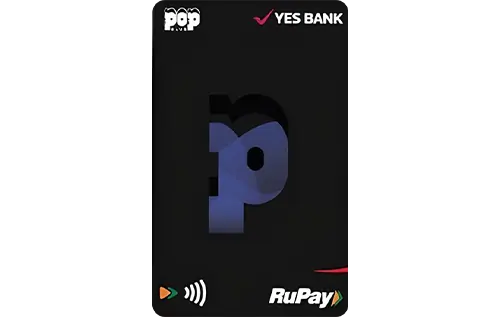

YES Bank POP Club Credit Card

★★★★☆ (4.5/5)

Best for young shoppers and frequent UPI users

Benefits:

Earn 10 POPcoins per ₹100 online spends

2 POPcoins per ₹100 offline spends

5% extra POPcoins on UPI via POP app

Welcome gifts: 500 POPcoins, Zomato Gold, PharmEasy Plus, Cleartrip ₹750 voucher, Cult Sport ₹500 voucher, 24 free Rapido rides

1% fuel surcharge waiver and travel discounts

Eligibility:

Age 21–60 years, salaried or self-employed

Minimum monthly income ₹25,000 or annual ITR ₹5 lakh

Fees:

Joining fee ₹0

Annual fee ₹399 (waived on ₹1.5 lakh spends)

Most Accessible. Most Youth-Friendly. Most Future-Ready.

Just stepping into adulthood or starting your career? Start with credit cards that are trusted by India’s students and young professionals — built to match your lifestyle, spending habits, and future financial goals.

This page features the most popular and widely applied-for cards by Gen Z and early-career professionals on CardMela — selected for their ease of access, modern rewards, and zero-stress approval process.

Why These Cards Click with Young Users

Beginner-Friendly Benefits

Cashback, discounts, and points on food delivery, streaming, recharges, and shopping — all the things you already use.

Low or Zero Fees

Affordable entry with zero joining fees and spend-based annual fee waivers.

Digital-First Experience

Control everything through apps — from setting limits to tracking spends.

Credit Building Made Easy

Start building your CIBIL score with timely payments and responsible usage.

Who Picks These Cards?

College students with minimal income

First-job professionals starting their credit journey

Freelancers and gig workers

Young adults looking to build credit early

Anyone looking for convenience and control in a card

Your Credit Journey Begins Here

CardMela helps you compare cards that fit your current life stage — whether you’re studying, earning your first salary, or freelancing.

Compare smart. Apply fast. Grow confidently.

Get your first serious credit card — the easy way.y in minutes. Find it today.